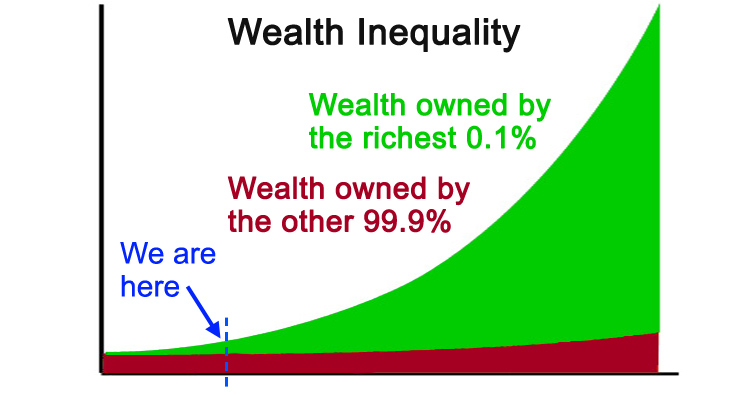

Eventually the richest 0.1% will own over 99.9% of all wealth!

1. Introduction

The rich are getting richer, while the poor are getting relatively poorer.

There’s ever more talk about how the percentage of total wealth held by the rich is increasing, but what surprises me is that people speak about it as if this state of affairs is unexpected.

I’ll demonstrate in this article that anyone who takes a few minutes to consider the basics of the capitalist system will see that the extreme concentration of wealth that’s occurring is exactly what we should expect; and furthermore, that we should expect the situation to become much worse.

In fact, it’s almost inevitable that eventually 0.1% of the world’s population will own 99.9% of the world’s wealth! And the more laissez-faire the economy is, the faster it will progress toward this depressing outcome.

Even though the percentage of wealth held by 99.9% of the population will decrease to 0.1%, the actual amount of wealth held by them will increase. It increases because, on average, economic growth will be positive and therefore the total amount of wealth in the system will increase.

As the size of the pie increases, their piece of the pie will be bigger than it was, but it will represent a smaller percentage of the entire pie.

Does this mean that we shouldn’t be concerned that 99.9% of wealth will eventually be owned by 0.1% of the population? No it doesn’t! There are at least two good reasons why we should be very concerned:

- With great wealth comes great power, and in a democratic society, giving so much power to unelected and unaccountable people has the effect of negating democracy.

- Even though the actual amount of wealth owned by the 99% is increasing, it would have increased at a faster rate if the super-rich had not garnered so much of it for themselves. So the 99% are worse off than they would have been, had the wealth been distributed more equitably.

[Note: I have made up the term “Law of World Domination” and I have originated this hypothesis. I think it would be great if economists and politicians recognised the truth of what is written here so that they can start doing something to fix this worsening problem before it’s too late.]

2. Assumptions

In this article I’ll predominantly describe how the Law of World Domination operates in the simplest form of capitalism – the extreme free market (laissez-faire) system, in which there is no government taxation. However, I’m confident that it also applies to current, real world, capitalist economies.

I’ll assume that the long term average rate of economic growth is positive and that, consequently, the total amount of wealth in the system is growing. (This assumption is in accord with historical fact.)

3. Overview

The Law of World Domination states that:

In an extreme free market capitalist economy, with the passing of time, a greater and greater percentage of overall wealth is accumulated by fewer and fewer individuals.

The consequence of this is that eventually 99.9% of all wealth will be owned by just 0.1% of the population.

The primary mechanism that causes this to happen is the fact that:

The real rate of return that an individual can obtain from their investments tends to increase as the wealth of the individual increases.

In other words, the game called capitalism is not played on a level field. The field is tilted in favour of those who have capital (‘capital’ is synonymous with ‘wealth’). The more capital one has, the more the field tilts in ones favour.

This happens because the richest can get, say, 5% return on investment whereas the less rich can only get, say, 3% and therefore the richest 0.1% will eventually end up owning 99.9% of all wealth.

A secondary mechanism, which has the effect of concentrating wealth in the hands of the wealthiest, is the fact that:

As an individual’s income increases he or she tends to put a greater percentage of it into income-generating wealth.

This article will explain the factors that lead wealth to accumulate disproportionately to the wealthiest, and will then examine possible counter-arguments and demonstrate that they are not valid.

4. The Basic Principle

When we examine the Law of World Domination we can see that it has two parts:

-

The proposition that:

The average rate of return that an individual can obtain from their investments tends to increase as the wealth of the individual increases.

-

The conclusion that:

If the first proposition is correct then it’s a mathematical certainty that 0.1% of the population will end up with 99.9% of the wealth.

In other words, if you want to disprove the Law of World Domination then you must disprove proposition 1, because if part one is true then part 2 is an indisputable logical consequence.

First I’ll explain why part 2 is a mathematical certainty and then I’ll demonstrate why proposition 1 is true.

5. Proving The Mathematical Model

Consider a system with the following characteristics:

- Individuals earn income from both labour and investment.

- All labour income is spent.

- All income from investment is reinvested.

- Individuals don’t pay any tax.

- It starts with a total of 1000 units of wealth.

-

The wealthiest 1% of the population:

- Owns 20% of the wealth.

- Earns a return on investment of 20% per annum.

-

The bottom 99% of the population

- Owns 80% of the wealth.

- Earns a return on investment of 5% per annum.

The following table shows the change in wealth for the two groups over a period of time:

Note that even though the actual wealth owned by the bottom 99% has increased from 800 units to 738 640 units, their percentage of wealth has fallen from 80% to 1%.

Therefore, the troubling social consequences which arise from the Law of World Domination have little to do with the economic prosperity of the 99% and much to do with the inevitable, detrimental effects on a democratic society that result from extreme concentration of power in the hands of a few unelected and unaccountable individuals.

6. Proof that Return on Investment Increases as wealth increases

6.1 Overview

There are several factors which contribute to the average rate of return on investment for an individual increasing as the wealth of that individual increases.

They include:

- Increasing number of investment opportunities.

There are many reasons why more investment opportunities become available to richer people. They will be explained in the next section. - Increasing percentage of income-generating wealth

Not all wealth produces income. As an individual’s wealth increases, a greater proportion of it is invested in order to produce additional income and therefore their average rate of return on wealth increases. - Decreasing cost of borrowing.

As you become wealthier, lenders will charge you less interest to borrow money to invest. - Tax avoidance and Tax evasion.

The wealthier you become the more you can spend to arrange your financial affairs so as to minimize or evade your tax liabilities. - Market Share Influence.

As an individual’s share in a given market increases he or she can influence the price in the market (either individually or in collusion with other individuals), and therefore he or she can achieve higher rates of return on their investments than individuals who can not influence the market. - Regulatory Environment and Government Influence.

Individuals with great wealth can use political donations, lobbyists and the media to influence governments to take actions that will increase their return on investment. - Corruption

Individuals with great wealth can influence the market through illegal means such as bribery and blackmail and corporate espionage and therefore significantly increase their return on investment.

6.2 Increasing number of investment opportunities

There are many different types of investment opportunities and not all are freely available to everyone.

Listed below are just some of the factors that contribute to the availability of investment opportunities.

Minimum investment requirements – managed funds

Some passive investment options require you to invest a minimum amount of money. Many hedge funds, for example, have a very high minimum investment requirement. You can’t just put $500 in a hedge fund like you can in a bank; you may need to invest several million dollars before they will agree to manage your money.

Even your average bank will offer a higher interest rate on a term deposit if the amount deposited is over a certain limit. For example, 5% on a 6 month term deposit of up to $50,000 but 5.25% on a 6 month term deposit of over $50,000.

Another example is trading in commodities, which are traded in fairly large discrete units such that the minimum amount of a certain commodity that you can buy may be $10000.

Minimum investment requirements – entrepreneurial

Entrepreneurial forms of investment, such as starting up a new business, usually require large amounts of money.

Starting a new airline, for example, may require hundreds of millions of dollars.

High Transaction costs

Some types of investments have transaction costs with a fixed component. This means that someone investing a lot of money will pay the same transaction fee as someone investing a small amount.

This is the case with share trading. Someone purchasing $100 worth of shares will pay the same $10 transaction fee as another person who purchased $10,000 worth of shares.

If the shares increase in value by 10% then the first person will make a profit of $10 minus $10 transaction fee which equals $0 and is a return on investment of 0%.

The second person, on the other hand will make a profit of $1000 minus $10 transaction fee which equals $990 and is a return on investment of 9.9%.

Research and management time required

Some investment opportunities require that the investor spend a lot of time to find them and/or to manage them. This means that people who have a full time job have a lot less time to spend on finding and managing their investments than people who are wealthy enough not to have to work.

As individuals become even richer they can even employ teams of people to find and manage their investments for them.

Trading in shares, commodities and currencies are examples of investments which require a lot of time to be done properly.

Who you know

Individuals usually associate with people who are in a similar socio-economic level. This means that the very rich usually associate with people who are business owners, entrepreneurs and full time investors and therefore it’s only natural that they will hear about good investment opportunities from their friends.

When very rich business owners are looking to expand their business through joint ventures etc. they will tend to select a suitable business partner from among their friends and acquaintances rather than an equally qualified stranger.

What you know

The very rich have access to information that’s not available to the public. This information may come from their friends and acquaintances who also tend to be extremely rich business owners and investors, or well connected in the government or other important institutions.

They can use this information to make wise investment choices or even to engage in insider trading.

Some extremely rich people may even employ people solely for the purpose of gathering such information.

Increased risk tolerance

When it comes to investing, it’s not wise to put all your eggs in the one basket; because if that particular investment fails then you lose all your money.

When you only have a small amount to invest you’re limited in your ability to diversify your investment because of minimum transaction costs and minimum investment requirements.

Therefore less wealthy people tend to seek safer investments; and usually the safer the investment the lower the rate of return.

Wealthy people can spread their investment portfolio across many different investment opportunities, so that if any one fails it has little impact on their overall wealth.

The classic example of this is investing in promising new businesses via seed funding or venture capital – nine out of ten investments may fail, but the tenth one may return a hundredfold.

6.3 Increasing Percentage of Income-Generating Wealth

For people that only have a little bit of wealth, a large percentage of it is tied up in assets that produce either no income or very little income. Some assets, such as their cars, and furniture actually depreciate in value and therefore produce negative income.

The family home may produce some capital gains income, but quite often people don’t take into consideration what will maximize their return on investment when making decisions about their home. Many people will, for example, spend money renovating their home even though they know it won’t increase the value of their home by an equivalent amount.

For extremely rich people the value of their cars and family home are small compared to the rest of their income-generating wealth and therefore their average rate of return on their wealth is higher.

6.4 Decreasing Cost of Borrowing

A common way to increase ones income and wealth is to borrow money to invest.

On average, wealthier people are able to secure loans at a lower interest rate because:

- They have more assets that they can use as collateral.

- Because their loans are larger the fixed costs incurred by the lender can be spread across a larger amount and therefore the lender can afford to offer a lower interest rate.

If the super-rich can borrow at 6% and invest at 10% then their net return on investment will be 4%, whereas a less rich person who has to borrow at 7% will only receive a net return on investment of 3%.

6.5 Tax Avoidance and Tax Evasion

The wealthier you become the more you can spend to arrange your financial affairs so as to minimize or evade your tax liabilities.

This factor does not apply in the simplest form of the economic model (extreme free market capitalism), but I have included it here as an example of the next level of variables that would be added to the model to make it more like the real world.

I’ve also mentioned it here because some critics of the Law of World Domination may claim that in the real world taxation will act as dampening force that will limit the concentration of wealth at the top. I, however, believe that the current taxation system exacerbates, rather than dampens,

the concentration of wealth.

If you only have a little wealth it isn’t worth hiring accountants to arrange your finances to minimize or evade paying taxes because the accounting fees will be more than the amount saved on tax.

As you become even wealthier it becomes financially viable to set up offshore entities in tax havens etc.

A person that deposits their money in a local bank at 5% may need to pay 30% income tax on that, so that their net rate of return will only be 3.5%. Whereas someone who deposits it in an offshore tax haven bank at 5% will not pay any tax and therefore their net rate of return is 5%.

6.6 Market Share Influence

As individuals become extremely wealthy they can act, either individually or in collusion with other wealthy individuals, to purchase a large share of a specific market in order influence the price in the market, and therefore they can achieve higher rates of return on their investments than individuals who can’t influence the market.

Buying up competing companies is one common way of removing competitors in order to keep prices high.

6.7 Regulatory Environment and Government Influence

Individuals with great wealth can act, either individually or in collusion with other wealthy individuals, to influence the decisions of governments or other statutory organisations in order to increase their return on investment.

The classic examples are property developers who always donate large amounts of money to political parties in order ensure that properties that they purchased relatively cheaply will be rezoned to allow them to re-develop it at a huge profit.

The sorts of outcomes that the super-rich may be seeking from government include:

- Ensuring that the effective tax rate on wealthy individuals is less than the effective tax rate on poorer individuals.

- Special tax breaks for their specific businesses or industry sectors.

- Government grants for their businesses

- Government to purchase goods and/or services from their businesses

- Bailouts for their failed businesses.

There are many methods that the very wealthy use to influence government:

- Political donations

At the very least, large political donations ensure that the very rich are able to speak directly with politicians whenever they want to – at the worst, they are bribes. - Lobbyists

The very rich can hire professionals whose job it is to talk to and influence politicians. - Media influence

Very rich people can employ publicity firms to get stories into the media in order to influence public opinion and influence government decisions.

Some people even suggest that some media owners, such as Rupert Murdoch, may own newspapers solely for the purpose of being able to influence government decisions. - Corruption

Individuals with great wealth can influence the government decisions and actions by bribing or blackmailing politicians and key government employees

6.8 Corruption

In addition to being able to bribe and blackmail politicians and government officials, extremely wealth people can also bribe and blackmail other companies, employees and members of the judiciary.

They can also afford to use such methods as:

- Corporate espionage

- Insider trading

Not all uber-rich people are corrupt, but those who are will gain an advantage over those who aren’t and therefore the corrupt will eventually fill the 0.1%.

7. As Income Increases so does Income-generating Wealth

Even if we were to ignore the fact that wealthier people are able to obtain a higher return on their investments, there is still another factor which causes wealth to concentrate disproportionately towards the wealthy.

As an individual’s income increases he or she tends to convert a greater percentage of it into income-generating wealth.

An individual can do two things with the money they receive as income – they can spend it or save it.

They can save it either in the form of cash or in the form of assets that can be converted to cash at a later date.

Savings can also be categorized as either income-generating or non-income-generating.

A car is an example of non-income-generating savings in the form of an asset. (Unless it’s a collector’s item that will appreciate in value.)

I will refer to the portion of income that’s spent as the Cost Of Living.

Income = CostOfLiving + Non-incomeGeneratingWealth + IncomeGeneratingWealth

People on a low income must spend all their money just to cover the cost of living – they are unable to save.

As income increases, though, the Cost Of Living doesn’t remain the same; it also increases because people tend to want to buy themselves some more of the luxuries of life before they start doing much saving.

As income increases further, their Cost Of Living also increases but at a lesser rate, which allows people to save some money – often in the form of a car.

As income increases further still their Cost Of Living also increases at a lesser rate and people start to save some money in the form of a family home, which in most cases tends to be only slightly income-generating.

It’s usually only when income increases further that people save some income in the form of income-generating Wealth.

As income grows significantly it becomes harder and harder to spend the income on day-to-day living expenses. Eventually a point is reached where it becomes impossible to spend any more on day-to-day living expenses and 100% of any additional income will go towards income-generating wealth.

When your income reaches the level at which you can start putting income towards income-generating wealth, then a feedback mechanism kicks in, whereby your income-generating wealth causes your income to increase and therefore you move up the scale so that you can now put a greater proportion of each additional unit of income towards additional income-generating wealth.

8. Disproving Possible Rebuttals

In this section I consider several possible counter arguments and demonstrate that they are not valid.

These counter arguments tend to take the position that while there is an underlying trend for wealth to accumulate towards the top, there are also counter trends that will impose upper limits on the accumulation of wealth, such that we will never reach the situation where 99% of the wealth is accumulated by the wealthiest 1%.

Even if we were to accept these counter-arguments, which I do not, the proponents of these arguments would still be required to tell us what they think the upper limit will be? Will it be impossible for the wealthiest 1% to accumulate 60% of the wealth, or 80% or 95%?

Regardless of whether the limit is 60% or 99%, the most important question is at what level does the accumulation of wealth to the wealthiest have a significant negative impact on a democratic society?

If there’s a natural limit at 80%, but negative impacts on society start occurring from 40% onwards, then there’s a strong case for taking actions that’ll prevent the concentration of wealth from increasing beyond 40%.

The two key questions for opponents of my hypothesis about the Law of World Domination are:

- What is the natural upper limit of wealth concentration in the system?

- At what level of wealth concentration do negative impacts start occurring to a democratic society?

I’ve identified three possible counter arguments:

- Overall consumption will drop as wealth becomes concentrated at the top thus preventing further concentration.

- In economic crises the wealthiest lose a greater proportion of their wealth because it is held in volatile assets.

- The rate of return on investment diminishes as wealth increases because eventually all the high yielding investments will already have been taken.

I examine each of these arguments in detail below.

8.1 Consumption Drops as Wealth Concentration Increases

This counter argument is based on the fact that wealthier people spend a smaller percentage of their income than less wealthy people do (as discussed previously in section 7). As your income increases, your spending also increases, but not as fast as your income does – you tend to save more.

Eventually you reach a sort of spending plateau because you already have everything you want to buy and there literally aren’t enough hours in the day for you to be able to spend any more money than you already are.

This counter-argument proposes that as wealth becomes concentrated in the hands of a few there will be a drop in overall consumption.

This drop in consumption will lead to increased unemployment and a further drop in consumption. This in turn leads to a drop in corporate profits and a consequent drop in share prices; and as wealthy people tend to invest a lot of their wealth in shares and other similarly volatile assets, then their wealth will drop significantly.

This argument is flawed in two ways.

Firstly, there will not be a drop in overall consumption because the actual amount of wealth held by the less wealthy will not drop – it’s only their percentage of the total wealth that drops. As was demonstrated in the earlier example (see table 1) the actual wealth of the bottom 99% will increase while their percentage of wealth decreases.

The increases in income of the bottom 90% will provide sufficient consumption to keep the economy operating normally.

Even if there were a drop in consumption this argument would still be flawed because in order for it to be valid we must assume that when there’s a period of asset deflation, that the amount of wealth held by the extremely rich will return to the levels of wealth experienced at the bottom of the previous deflationary period. This argument will be refuted in the next section.

8.2 Wealthiest Lose More During Economic Crises

This argument states that during economic crises the wealthiest lose a greater proportion of their wealth than less wealthy people because the very wealthy tend to hold their wealth in volatile assets such as shares. As a result of this the very rich will never be able to acquire 99% of total wealth.

This argument is flawed because in order for it to be valid, we must assume that when there’s a period of asset deflation, that the amount of wealth held by the extremely rich will drop to the same level of wealth they had at the bottom of the previous deflationary period.

In other words, the extremely rich would have to give up all they’ve gained since the previous economic crisis, and then they would have to continue with this cycle (of gaining and then losing all the gains) over subsequent economic cycles.

If there are some extremely rich individuals that are doomed to experience such a yo-yo fate, then there must surely exist some that are clever enough, or lucky enough, to ensure that they keep at least some of their gains each time.

There are plenty of examples of people who shorted the market and made lots of money while the stock market crashed.

Indeed, if this phenomenon does, in fact, exist then surely it further adds to the process of concentrating wealth to the very few, because rather than flattening the differences in wealth it further exacerbates it by dividing the super-rich into those that are able to profit, or at least preserve their wealth, during a period of asset deflation, and those that are unable to.

Indeed, some astute investors who foresee a crisis, will position their wealth so as to minimise their losses (such as converting shares to cash); or even to profit from it (such as by shorting the market).

Then at the depths of the crisis, or immediately after it, when asset values are at their lowest, the extremely rich will use the cash to purchase assets at bargain basement prices. After such crises, the cost of borrowing money is usually very low and therefore rich people with a lot of assets can borrow cheaply against their assets in order to snap up even more of the incredible investment opportunities that are available at such times.

Therefore economic crises do not limit the growth of wealth by the extremely rich, they merely generate more high return investment opportunities for them.

In fact, I suspect that there exist extremely rich investors who wouldn’t hesitate to initiate or exacerbate a financial crisis which they have positioned themselves to benefit from.

8.3 Rate of Return on Investment Decreases as Wealth Concentration Increases

Some may make the argument that the capitalist system naturally limits itself because eventually, as wealth increases, there will be fewer high yielding investment opportunities than there is cash looking to be invested and therefore some of that cash will have to be invested in lower yielding investments.

I don’t doubt that this is a genuine phenomenon, but I do disagree with its overall impact on the Law of World Domination; primarily because the less wealthy will be just as impacted by this phenomenon as the extremely rich are – their return on investment will also decrease, and therefore the relative differences will remain the same.

But let’s first examine the phenomenon itself in more detail and deal with its consequences later.

This phenomenon has two primary causes, which are related to the fact that there are primarily two types of investment opportunities. Each type of investment opportunity is subject to a marketplace in which there are consumers of investment products and suppliers of investment products. But the two marketplaces are very different.

Commoditized investment products.

The largest market sells a commoditized investment product. This is where people invest their money in products such as bank deposits, bonds, shares, commodities and currencies. In this market there are a large number of very similar products which are available to lots of people.

As with all similar markets, this market is affected by the classic laws of supply and demand – if demand exceeds supply then prices will rise and if supply exceeds demand then prices will drop.

In this market, where banks are taking term deposits, the bank is the consumer who is purchasing the use of cash for a period of time; the price they’re paying the supplier (investor), is the interest.

The bank then turns the borrowed cash into a product that it sells to its customers, in the form of loans. This is a different market to the above-mentioned one. In this market the investor’s cash is a raw material used by the bank to manufacture it’s end product – a loan to someone else.

Therefore there’s a limit to the amount of cash that a bank needs to get from deposits – it only needs enough to produce the loans that it can sell.

Therefore if the bank only needs X amount of cash to manufacture its loans, but the supply of cash is 2X then the price that banks are prepared to pay for the cash will drop. In other words, when the economy wants to deposit more money in banks than it wants to borrow from banks, the interest paid by banks on deposits will drop.

The argument is that because the wealthy save a greater proportion of their income than the poor do, that as wealth accumulates to the wealthiest, the amount of savings in the system will increase, and therefore the interest paid on those savings will drop.

I agree that this phenomenon is real. However, it won’t prevent the wealthiest from being able to obtain a higher rate of return on investment than the less wealthy because the less wealthy will also be effected by the lower interest rates.

We can imagine, for example, an extreme situation where the banks only pay 0.1% interest on deposits of under $100 000 and 0.12% on deposits over $100000 – the disparity in rates of return on investment will be maintained.

Ad hoc entrepreneurial investment products

The other type of investment marketplace is one in which each product is unique. This is where people invest in starting up new companies, often to provide new products and services.

One can imagine a situation in which there is so much seed capital and venture capital available to start-up companies that all of the good start-ups have sufficient funding, and all that’s left to invest in are the ones that have less probability of making a good return on investment. (Sort of like during the dot-com bubble.)

Yes, this effect will reduce the average return on investment obtained by the wealthiest 1% but the reduction is not sufficient to reduce it to the same level as the rate of return obtained by the less wealthy.

There are so many other factors that contribute towards the wealthiest obtaining a higher rate of return – this phenomenon only negates one of those factors.

9. Conclusion

In this article I’ve shown that:

- The real rate of return that an individual can get on their investment tends to increase as the wealth of the individual increases; and that as a consequence

- a greater and greater percentage of overall wealth is accumulated by fewer and fewer individuals

I’ve also shown that there isn’t anything in the system that would impose a natural limit on the concentration of wealth.

While the definition of the Law of World Domination refers to an extreme free market economy I am confident that it also applies to current, real world, capitalist economies. In some countries a progressive income tax system acts to slow the process of wealth concentration, but in many countries the tax system just acts to exacerbate it.

As the old saying goes: “Money is power”; and with a lot of money comes a lot of power.

The sobering questions we are all now faced with are:

- How will this concentration of wealth change our society?

- Can a democracy still function effectively in a society in which 99.9% of the wealth is held by 0.1% of the population?

Please leave a comment and tell me what you think!

If you want to read about my proposed solution to prevent the 0.1% owning 99.9% of the wealth then read my article on Capped Capitalism

Logical ideas and commentary about society, politics

Logical ideas and commentary about society, politics

Your critique of the article was great but your assumption of unlimited growth is inconsistent with the finiteness of our physical habitat. I invite you to read “Prosperity, Poverty or Extinction? Humanity’s Choices.” Allen Cookson 2016. Publisher Xlibris. Available at online booksellers. This book offers feasible solutions to humanity’s quandaries. It has had favourable reviews including World Economic Association Newsletter.

Library of Congress Control Number 2012920598

hardcover 978-4797-4255-4 softcover 978-4797-4254-7 ebook 978-4797-4256-1

Thanks for the comment and the book suggestion, I’ll take a look.

Regarding the problem of unlimited growth:

I totally agree that it is extremely unlikely for the economy to be able to have unlimited growth. And even if it did come close, it wouldn’t be straight line growth – any additional growth would be smaller and smaller percentages as opportunities for fast growth run out.

I believe that limited growth isn’t a problem for the Law of World Domination, because if there is limited growth potential then the 99% will also be impacted by that – so the relationship between the wealth and the non-wealthy will remain.

Another factor that will come into play (not described in my article) is that the rich do not need the economy to grow in order to grow their wealth. They can buy up existing companies and properties. This is what we tend to see in many markets – where the biggest businesses buy up the smaller competitors and try to gain a monopoly.

By the way, how did you find my article?